GoSend, in collaboration with PasarPolis, provides insurance on every item you send to ensure that the item arrives at its destination in good condition. Using the GoSend service, you automatically get a maximum insurance coverage value of up to Rp1.000.000 without additional costs.

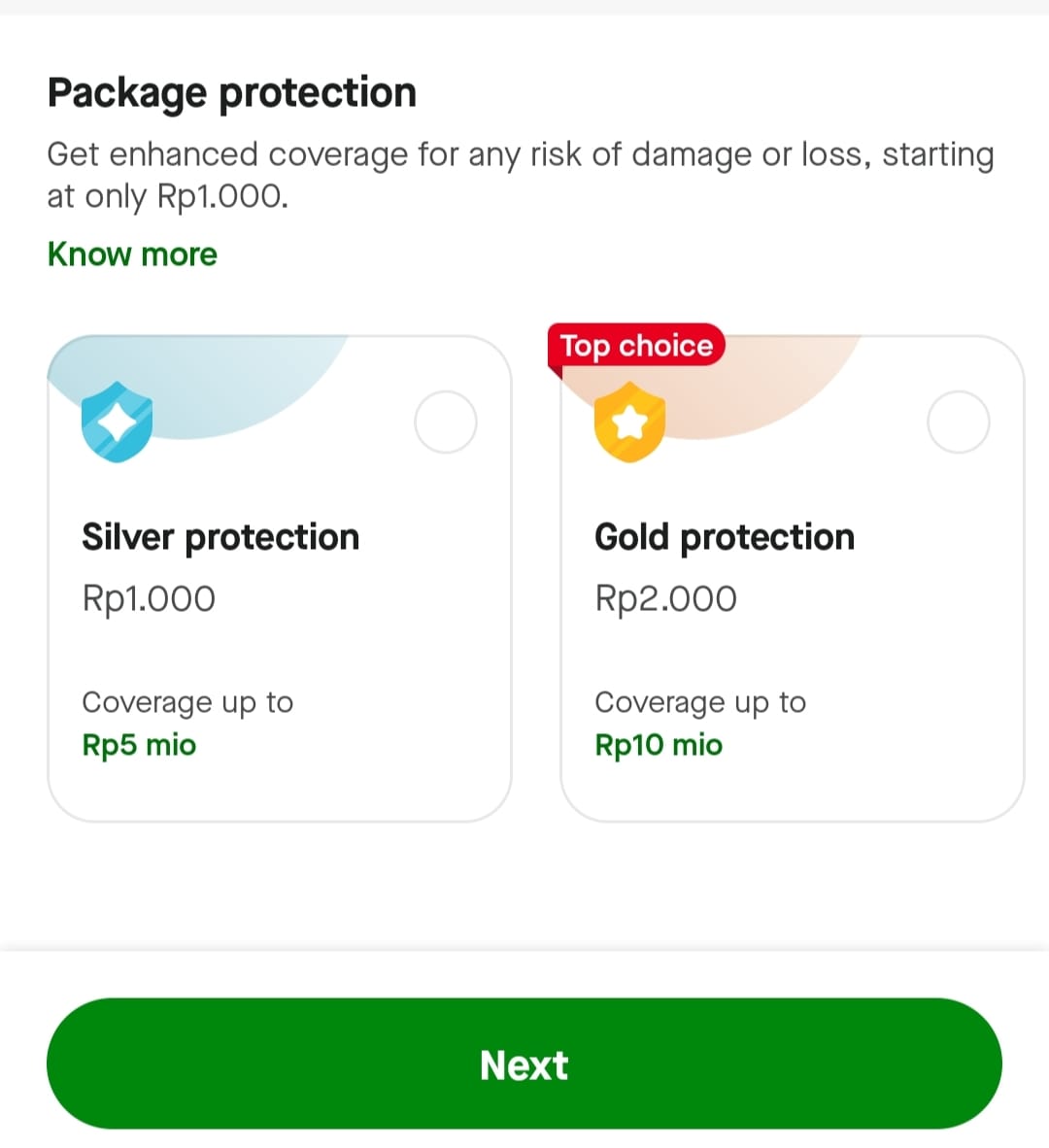

You can also get additional insurance by choosing one of the extra protections provided by GoSend.

Transaction via Gojek app:

Here’s how to choose it:

Transaction via e-commerce:

Each time you use GoSend service on the e-commerce partner platform, you automatically get maximum insurance coverage of up to Rp10.000.000 without additional costs.

Terms of how to claim

If you fail to put details on the package details section, GoSend and / or insurance providers will use this provision to calculate the value of the coverage limit for the goods.

Click HERE for more information like how to claim, types of goods that cannot be insured, claim submission limit.

You can also read a summary of insurance benefits and claim status on the MyInsurance page (only available to Android users with Gojek app version 4.76 and above).

Hope this information helps you.